Are You Suddenly Paying More for Your Medications?

Your Copay Assistance May No Longer Count Towards Your Deductible or Maximum Out-of-Pocket limit

What is a copay accumulator adjustment policy?

Are you suddenly paying more for your medications?

If you are among the millions of patients who rely on copay coupons or assistance from a drug company to afford your medications, you may have been suddenly asked to pay more for your drugs when you order them or pick them up at the pharmacy. If that has happened to you, it may be due to new insurance company policies that don’t count your coupon or other financial assistance toward your annual deductible or out-of-pocket maximum.

Why are you facing new, steep out-of-pocket costs?

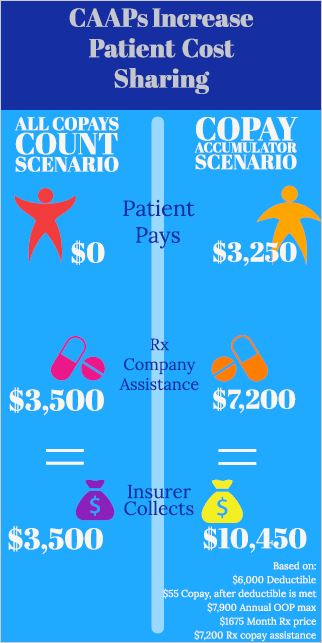

You may be experiencing what is sometimes called “copay accumulators” or CAAPs that are affecting patients across the country. Confusing language has been slipped in the fine print of health insurance plans that leaves patients on the hook for potentially thousands of dollars in increased and unexpected out of pocket costs.

The Good News

The good news is that some states have adopted laws that prohibit insurance companies and PBMs from using copay accumulators altogether and ensure that your copay assistance counts toward your annual deductible and out-of-pocket maximum. And many more states are looking to do the same in 2020.

Click here to find out if your state has adopted one of these laws.

The Bad News

The US Department of Health & Human Services has squashed a victory for patients when they revoked their initial instruction to insurance companies and PBMs stating that they could only use copay accumulators in limited circumstances:

- There is no generic available for your brand name drug

- You gained access to the brand name drug using the insurer’s appeals or exceptions process

Now in the proposed 2021 Notice of Benefit and Payment Parameters, HHS says insurers have the flexibility to determine whether to include or exclude coupon amounts from the annual limitation on cost sharing, regardless of whether your drug has generic available.

How Does It Work?

Increased Costs:

For months, you will use their copay assistance to pay for their prescriptions without issue. At some point, the assistance runs out. You then learn that the insurance company has not been counting the copay assistance towards your deductible or cost-sharing limits, forcing you to pay the full cost for your drugs.

Some patients may abandon their medication because they can’t afford it. A recent study concluded that more than 70 percent of patients who were faced with paying more than $250 for their prescription did not pick them up.

Misleading, Hidden Language:

When you shop for and choose an insurance plan, the issuer must provide detailed information up front about all the policies and costs related to the plan. Sometimes, insurance companies use complicated and confusing language to describe copay accumulator policies, which can be buried in the fine print of insurance policy documents. Unless you are looking for it, and know where to find it, you might miss it!

Follow the links below to see examples of the plan language.

See the Impact on Patients See Insurance Plan Examples